|

Posted: 27 Jul 2016 Michael Snyder THE ECONOMIC COLLAPSE BLOG

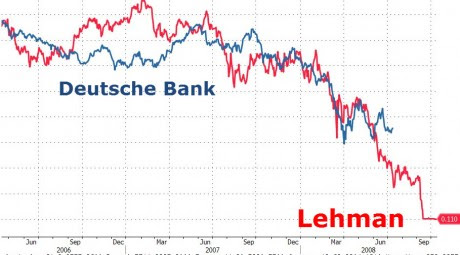

The biggest and most important bank in the biggest and most important country in Europe continues to implode right in front of our eyes. If you follow my work regularly, you probably already know that I issued a major alarm about Deutsche Bank last September. Subsequently, Deutsche Bank stock hit an all-time low.

Then I sounded the alarm about Deutsche Bank again back in May, and once again that was followed by another all-time low for Deutsche Bank. And then I warned about Deutsche Bank again in early June, and you can probably imagine what happened after that. Over the past year, this German banking giant has literally been coming apart at the seams, and in so many ways it is paralleling exactly what happened to Lehman Brothers back in 2008. Today, we got some more bad news from Deutsche Bank. Compared to the exact same period last year, profits were down 98 percent. A nearly 100 percent drop in net income spooked a lot of investors, and Deutsche Bank shares got hit hard on Wednesday. Of course Deutsche Bank shares are already down by more than half over the past 12 months, and the financial sharks can smell blood in the water. Just like Lehman Brothers in 2008, Deutsche Bank is essentially in panic mode at this point. They recently announced that they will be closing 188 branches and that 3,000 workers will be losing their jobs. But this could just be the beginning of the layoffs at the bank. According to some reports, the bank could cut up to 35,000 jobs by the year 2020, and CEO John Cryan recently admitted that they “may have to accelerate cost-cutting measures“. What makes all of this even more alarming is that Deutsche Bank is widely considered to be “the most dangerous bank” on the entire planet. The following comes from a CNN article posted just today entitled “The world’s riskiest bank is in trouble“… What is going on with Deutsche Bank?The primary reason why Deutsche Bank is “the world’s riskiest bank” is because of the mammoth derivatives portfolio that is possesses. It currently has 42 trillion euros of exposure to derivatives, which is an amount of money about 13 times the size of the entire German economy. When Deutsche Bank finally goes down for good, it is going to be “the shot heard around the financial world”, and it will be a disaster many times greater than the collapse of Lehman Brothers in 2008. Just consider what Jeff Gundlach had to say about the bank earlier this year… “Banks are dying and policymakers don’t know what to do,” Gundlach said. “Watch Deutsche Bank shares go to single digits and people will start to panic… you’ll see someone say, ‘Someone is going to have to do something.'”As I write this, shares of Deutsche Bank are sitting at just $13.63, and many experts are having a very difficult time finding any reason for optimism. In fact, Edward Misrahi has stated that the bank is his number one short trade, and Jim Collins says that “it is just impossible” to recommend buying shares of Deutsche Bank even at this depressed level… As an equity analyst, it is just impossible to recommend shares of a bank that is not growing revenue. So really, Deutsche is an untouchable, and the stock market is trying — to the tune of a 58% decline in DB’s market value in 12 months — to recalibrate Deutsche’s market capitalization to the true value of its assets net of liabilities. That’s a painful journey.I don’t mean to just pick on Deutsche Bank. Certainly there are a lot of other major banks around the globe that are also teetering on the brink right now. Just take a look at Italy. Basically their entire banking system is in the process of melting down. But the utter collapse of Italy’s banking system won’t have the same kind of worldwide impact that the collapse of Deutsche Bank will. Unlike some of his predecessors, CEO John Cryan is being honest about some of the struggles that Deutsche Bank is going through right now, and he admits that they may need to be “more ambitious in our restructuring”. The following comes from Business Insider… Cryan said in a statement (emphasis ours):Yes, I know that the stock market in the United States has been setting all sorts of all-time record highs lately. But that doesn’t change what is going on in the rest of the world one bit. The financial crisis that has been gripping Europe, Asia, South America and most of the rest of the planet since the second half of last year is accelerating. And it is inevitable that the U.S. is going to be experiencing some very real pain in the not too distant future as well. So even though things may seem a bit quiet this summer in the financial world, the truth is that there is a whole lot going on under the surface. Deutsche Bank is one glaringly obvious example of this, but there are many others all over the globe. And not too long from now, the dominoes will begin to fall very rapidly. |

Warren Buffett once referred to derivatives as "financial weapons of mass destruction," and it was inevitable that they would begin to wreak havoc on our financial system at some point. While things may seem somewhat calm on Wall Street at the moment, the truth is that a great deal of trouble is bubbling just under the surface.

Something happened in mid-September that required an unprecedented $405 billion surge of Treasury collateral into the repo market. I know—that sounds very complicated, so I will try to break it down more simply for you. It appears that some very large institutions have started to get into a significant amount of trouble because of all the reckless betting they have been doing.

This is something I have warned would happen over and over again. In fact, I have written about it so much that my regular readers are probably sick of hearing about it. But this is what is going to cause the meltdown of our financial system.

Many out there get upset when I compare derivatives trading to gambling, and perhaps it would be more accurate to describe most derivatives as a form of insurance. The big financial institutions assure us that they have passed off most of the risk on these contracts to others and so there is no reason to worry according to them.

Well, personally I don't buy their explanations, and a lot of others don't either. On a very basic, primitive level, derivatives trading is gambling. This is a point that Jeff Nielson made very eloquently in a piece he recently published:

No one "understands" derivatives. How many times have readers heard that thought expressed (please round-off to the nearest thousand)? Why does no one understand derivatives? For many, the answer to that question is that they have simply been thinking too hard. For others; the answer is that they don't "think" at all.Derivatives are bets. This is not a metaphor, or analogy, or generalization. Derivatives are bets. Period. That's all they ever were. That's all they ever can be.

One very large financial institution that appears to be in serious trouble with these financial weapons of mass destruction is Glencore. At one time, Glencore was considered to be the 10th-largest company on the entire planet, but now it appears to be coming apart at the seams, and a great deal of their trouble seems to be tied to derivatives. The following comes from Zero Hedge:

Of particular concern, they said, was Glencore's use of financial instruments such as derivatives to hedge its trading of physical goods against price swings. The company had $9.8 billion in gross derivatives in June 2015, down from $19 billion in such positions at the end of 2014, causing investors to query the company about the swing.Glencore told investors the number went down so drastically because of changes in market volatility this year, according to people briefed by Glencore. When prices vary significantly, it can increase the value of hedging positions.Last year, there were extreme price moves, particularly in the crude-oil market, which slid from about $114 a barrel in June to less than $60 a barrel by the end of December.That response wasn't satisfying, said Michael Leithead, a bond fund portfolio manager at EFG Asset Management, which managed $12 billion as of the end of March and has invested in Glencore's debt.

According to Bank of America, the global financial system has about $100 billion of exposure overall to Glencore. So if Glencore goes bankrupt, it will be a major event. At this point, Glencore is probably the most likely candidate to be "the next Lehman Brothers."

And it isn't just Glencore that is in trouble. Other financial giants, such as Trafigura, are in deep distress as well. Collectively, the global financial system has approximately a half-trillion dollars of exposure to these firms:

Worse, since it is not just Glencore that the banks are exposed to but very likely the rest of the commodity trading space, their gross exposure blows up to a simply stunning number:For the banks, of course, Glencore may not be their only exposure in the commodity trading space. We consider that other vehicles such as Trafigura, Vitol and Gunvor may feature on bank balance sheets as well ($100 bn x 4?)Call it a half-trillion dollars in very highly levered exposure to commodities: an asset class that has been crushed in the past year.

The mainstream media are not talking much about any of this yet, and that is probably a good thing. But behind the scenes, unprecedented moves are already taking place.

When I came across the information I am about to share with you, I was absolutely stunned. It comes from Investment Research Dynamics, and it shows clearly that everything is not "OK" in the financial world:

Something occurred in the banking system in September that required a massive reverse repo operation in order to force the largest-ever Treasury collateral injection into the repo market. Ordinarily the Fed might engage in routine reverse repos as a means of managing the Fed funds rate.

However, there have been sudden spikes up in the amount of reverse repos that tend to correspond the some kind of crisis—the obvious one being the de facto collapse of the financial system in 2008:

What in the world could possibly cause a spike of that magnitude?

Well, that same article that I just quoted links the troubles at Glencore with this unprecedented intervention:

What's even more interesting is that the spike-up in reverse repos occurred at the same time—Sept. 16—that the stock market embarked on an 8-day cliff dive, with the S&P 500 falling 6 percent in that time period. You'll note that this is around the same time that a crash in Glencore stock and bonds began. It has been suggested by analysts that a default on Glencore credit derivatives either by Glencore or by financial entities using derivatives to bet against that event would be analogous to the "Lehman moment" that triggered the 2008 collapse.The blame on the general stock market plunge was cast on the Fed's inability to raise interest rates. However that seems to be nothing more than a clever cover story for something much more catastrophic which began to develop out sight in the general liquidity functions of the global banking system.

Back in 2008, Lehman Brothers was not "perfectly fine" one day and then suddenly collapsed the next. There were problems brewing under the surface well in advance.

Well, the same thing is happening now at banking giants such as Deutsche Bank, and at commodity trading firms such as Glencore, Trafigura and The Noble Group.

And of course a lot of smaller fish are starting to implode as well. I found this example posted on Business Insider recently:

On Sept. 11, Spruce Alpha, a small hedge fund which is part of a bigger investment group, sent a short report to investors.The letter said that the $80 million fund had lost 48 percent in a month, according the performance report seen by Business Insider.There was no commentary included in the note. No explanation. Just cold hard numbers.

Wow—how do you possibly lose 48 percent in a single month?

It would be hard to do that, even if you were actually trying to lose money on purpose.

Sadly, this kind of scenario is going to be repeated over and over as we get even deeper into this crisis.

Meanwhile, our "leaders" continue to tell us that there is nothing to worry about. For example, just consider what former Fed Chairman Ben Bernanke said:

Former Federal Reserve chairman Ben Bernanke doesn't see any bubbles forming in global markets right now.But he doesn't think you should take his word for it.And even if you did, that isn't the right question to ask anyway.Speaking at a Wall Street Journal event on Wednesday morning, Bernanke said, "I don't see any obvious major mispricings. Nothing that looks like the housing bubble before the crisis, for example. But you shouldn't trust me."

I certainly agree with that last sentence. Bernanke was the one telling us that there was not going to be a recession back in 2008, even after one had already started. He was clueless back then and he is clueless today.

Most of our "leaders" either don't understand what is happening or they are not willing to tell us.

So that means that we have to try to figure things out for ourselves the best that we can. And right now there are signs all around us that another 2008-style crisis has begun.

Personally, I am hoping there will be a lot more days like today, when the markets were relatively quiet and not much major news happened around the world.

Unfortunately for all of us, these days of relative peace and tranquility are about to come to a very abrupt end.

Michael T. Snyder is the publisher of The Economic Collapse Blog and author of The Beginning of the End.

For a limited time, we are extending our celebration of the 40th anniversary of Charisma. As a special offer, you can get 40 issues of Charisma magazine for only $40!

NEW - Life in the Spirit is your Spirit-filled teaching guide. Encounter the Holy Spirit, hear God speak to you, and enjoy timeless teachings on love, mercy and forgiveness.LEARN MORE!