|

Posted: 29 Mar 2016 Michael Synder THE ECONOMIC COLLAPSE BLOG

Ten years ago, a major Hollywood film entitled “Idiocracy” was released, and it was an excellent metaphor for what would happen to America over the course of the next decade. In the movie, an “average American” wakes up 500 years in the future only to discover that he is the most intelligent person by far in the “dumbed down” society that he suddenly finds himself in. Sadly, I truly believe that if people of average intellect from the 1950s and 1960s were transported to 2016, they would likely be considered mental giants compared to the rest of us.

We have a country where criminals are being paid $1000 a month not to shoot people, and the highest paid public employee in more than half the states is a football coach. Hardly anyone takes time to read a book anymore, and yet the average American spends 302 minutes a day watching television. 75 percent of our young adults cannot find Israel on a map of the Middle East, but they sure know how to find smut on the Internet. It may be hard to believe, but there are more than 4 million adult websites on the Internet today, and they get more traffic than Netflix, Amazon and Twitter combined. What in the world has happened to us? How is it possible that we have become so stupid? According to a brand new report that was recently released, almost 10 percent of our college graduates believe that Judge Judy is on the Supreme Court… The American Council of Trustees and Alumni publishes occasional reports on what college students know.It can be tempting to laugh at numbers like these until you realize that survey after survey has come up with similar results. Just consider what Newsweek found a few years ago… When NEWSWEEK recently asked 1,000 U.S. citizens to take America’s official citizenship test, 29 percent couldn’t name the vice president. Seventy-three percent couldn’t correctly say why we fought the Cold War. Forty-four percent were unable to define the Bill of Rights. And 6 percent couldn’t even circle Independence Day on a calendar.Even worse were the extremely depressing results of a study conducted a few years ago by Common Core… *Only 43 percent of all U.S. high school students knew that the Civil War was fought some time between 1850 and 1900. *More than a quarter of all U.S. high school students thought that Christopher Columbus made his famous voyage across the Atlantic Ocean after the year 1750. *Approximately a third of all U.S. high school students did not know that the Bill of Rights guarantees freedom of speech and freedom of religion. *Only 60 percent of all U.S. students knew that World War I was fought some time between 1900 and 1950. Of course survey results can be skewed, and much hinges on how the questions are asked. However, even studies that are scientifically conducted confirm how stupid America has become. In fact, a report from the Educational Testing Service found that Americans are falling way behind much of the rest of the industrialized world. The following comes from CBS News… Americans born after 1980 are lagging their peers in countries ranging from Australia to Estonia, according to a new report from researchers at the Educational Testing Service (ETS). The study looked at scores for literacy and numeracy from a test called the Program for the International Assessment of Adult Competencies, which tested the abilities of people in 22 countries.Out of 22 countries that were part of the study, the Educational Testing Service found that Americans were dead last in tech proficiency, dead last in numeracy and only two countries performed worse than us when it came to literacy proficiency… Half of American Millennials score below the minimum standard of literacy proficiency. Only two countries scored worse by that measure: Italy (60 percent) and Spain (59 percent). The results were even worse for numeracy, with almost two-thirds of American Millennials failing to meet the minimum standard for understanding and working with numbers. That placed U.S. Millennials dead last for numeracy among the study’s 22 developed countries.So why has this happened? Why have we become such an extremely stupid nation? Well, at least a portion of the blame must be directed at our system of education. The following is an excerpt from an article written by reporter Mark Morford. In this article, he shared how one of his friends which had served for a very long time as a high school teacher in Oakland, California was considering moving out of the country when he retired due to the relentless “dumb-ification of the American brain”… It’s gotten so bad that, as my friend nears retirement, he says he is very seriously considering moving out of the country so as to escape what he sees will be the surefire collapse of functioning American society in the next handful of years due to the absolutely irrefutable destruction, the shocking — and nearly hopeless — dumb-ification of the American brain. It is just that bad.And of course things don’t get much better when it comes to our college students. In a previous article, I shared some statistics from USA Today about the rapidly declining state of college education in the United States… -“After two years in college, 45% of students showed no significant gains in learning; after four years, 36% showed little change.” -“Students also spent 50% less time studying compared with students a few decades ago” -“35% of students report spending five or fewer hours per week studying alone.” -“50% said they never took a class in a typical semester where they wrote more than 20 pages” -“32% never took a course in a typical semester where they read more than 40 pages per week.” I spent eight years studying at some of the finest public universities in the country, and I can tell you from personal experience that even our most challenging college courses have been pathetically dumbed down. And at our “less than finest” public universities, the level of education can be something of a bad joke. In another previous article, I shared some examples of actual courses that have been taught at U.S. universities in recent years… -“What If Harry Potter Is Real?” -“Lady Gaga and the Sociology of Fame” -“Philosophy And Star Trek” -“Learning From YouTube” -“How To Watch Television” Could you imagine getting actual college credit for a course entitled “What If Harry Potter Is Real?” This is why many of our college graduates can barely put two sentences together. They aren’t being challenged, and the quality of the education most of them are receiving is incredibly poor. But even though they aren’t being challenged, students are taking longer to get through college than ever. Federal statistics reveal that only 36 percent of all full-time students receive a bachelor’s degree within four years, and only 77 percent of all full-time students have earned a bachelor’s degree by the end of six years. Of course our system of education is not entirely to blame. The truth is that young Americans spend far more time consuming media than they do hitting the books, and what passes for “entertainment” these days is rapidly turning their brains to mush. According to a report put out by Nielsen, this is how much time the average American spends consuming media on various devices each day… Watching live television: 4 hours, 32 minutes Watching time-shifted television: 30 minutes Listening to the radio: 2 hours, 44 minutes Using a smartphone: 1 hour, 33 minutes Using Internet on a computer: 1 hour, 6 minutes When you add it all up, the average American spends more than 10 hours a day plugged into some form of media. And if you allow anyone to pump “programming” into your mind for 10 hours a day, it is going to have a dramatic impact. In the end, I truly believe that we all greatly underestimate the influence that the mainstream media has on all of us. We willingly plug into “the Matrix” for endless hours, but then somehow we still expect “to think for ourselves”. There are very few of us that can say that we have not been exposed to thousands upon thousands of hours of conditioning. And all of that garbage can make it very, very difficult to think clearly. It is not because of a lack of input that we have become so stupid as a society. The big problem is what we are putting into our minds. If we continue to put garbage in, we are going to continue to get garbage out, and that is the cold, hard reality of the matter. |

Showing posts with label Michael Synder. Show all posts

Showing posts with label Michael Synder. Show all posts

Wednesday, March 30, 2016

Depressing Survey Results Show How Extremely Stupid America Has Become - Michael Synder THE ECONOMIC COLLAPSE BLOG

Monday, March 28, 2016

23 Percent Of Americans In Their Prime Working Years Are Unemployed - Michael Synder THE ECONOMIC COLLAPSE BLOG

|

Posted: 27 Mar 2016 Michael Synder THE ECONOMIC COLLAPSE BLOG

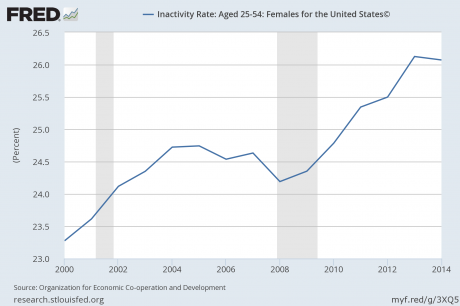

Did you know that when you take the number of working age Americans that are officially unemployed (8.2 million) and add that number to the number of working age Americans that are considered to be “not in the labor force” (94.3 million), that gives us a grand total of 102.5 million working age Americans that do not have a job right now? I have written about this before, but today I want to focus just on Americans that are in their prime working years. When you look at only Americans that are from age 25 to age 54, 23.2 percent of them are unemployed right now. The following analysis and chart come from the Weekly Standard… Here’s a chart showing those in that age group currently employed (95.6 million) and those who aren’t (28.9 million): Clearly, we have never recovered from the impact of the last recession. But let’s try to put these numbers in context. Below, I would like to share two charts with you. They show what has happened to the inactivity rates for men and for women in their prime working years in the United States in recent years. In order to be considered “inactive”, you can’t have a job and you can’t be looking for a job. So this subset of people is smaller than the group that we were talking about above. The 23.2 percent of Americans in their prime working years that are unemployed right now includes those that are looking for a job and those that are not looking for a job. These next two charts do not include anyone that has a job or that is currently looking for a job. These charts only cover “inactive” people in their prime working years that are not considered to be in the labor force. As you can see in this first chart, the inactivity rate for men in their prime working years exploded higher during the last recession and then continued to go up even after the recession supposedly ended. At this point, it is hovering near all-time record highs. Does this look like an “economic recovery” to you?… For both men and women in their prime working years, the inactivity rate is even higher than it was during the last recession and is hovering near the all-time record. All of these people neither have a job nor are they looking for one. So what in the world is going on here? Are they independently wealthy? Have these people found rich spouses to marry so they don’t have to work? No, the truth is that the middle class in America is steadily eroding and poverty is absolutely exploding. Credit card debt has soared to a new record high, and 48 percent of all U.S. adults under the age of 30 believe that “the American Dream is dead”. The issue isn’t that people don’t want to work. The issue is that people cannot find enough work. And even if you have a job, that does not mean that you are on easy street. According to the Social Security Administration, 51 percent of all American workers make less than $30,000 a year. Tens of millions of Americans are now among the ranks of “the working poor”. So many families are watching their expenses soar while their paychecks go down or stagnate. If you are in this situation right now, then you probably know how exceedingly stressful it can be. Just look at what is happening to the cost of health insurance. The following comes from Fox News… Health insurance premiums have increased faster than wages and inflation in recent years, rising an average of 28 percent from 2009 to 2014 despite the enactment of Obamacare, according to a report from Freedom Partners.And I am not exactly sure where they got those numbers. Personally, I know that my health insurance rates have gone up far faster than that. Two years ago, my health insurance company wanted to double the health insurance premiums for my family even though we never get sick. So I switched to another insurance company that offered a policy that was only about 30 percent higher than my last one. But then when it came time to renew, that insurance company wanted to raise my rate by another 50 percent. Thanks to Obamacare, American families are being absolutely crippled by the cost of health care. And of course we are seeing the rising cost of living so many other places as well. Our paychecks are being squeezed harder and harder, and this is absolutely killing the middle class. In fact, the middle class in America is now a minority for the first time ever. And now for the real bad news – this is about as good as things are ever going to get in this country. As you can see from what I have shared above, we never really had any sort of meaningful “economic recovery”, and now we have entered the early phases of the next major downturn. So where do we go from here? Unfortunately, our debt-fueled prosperity has provided us with a massively inflated standard of living that is not even close to sustainable. As this bubble bursts, the economic pain is going to be absolutely unprecedented. But it won’t be just economic pain that we are facing. In my new book, I detail the things that I believe that are coming to this country, and I explain why the entire planet will soon be facing incredibly challenging times. It is going to be one of the most controversial Christian books of 2016, because it directly challenges many of the things that are being taught in mainstream churches today. My book is an ominous message of warning and an inspiring message of hope, and I truly believe that it is the most important thing that I have ever written. No matter how you may see the future, the key is that we all learn to love one another. The years ahead are going to be extremely challenging, and those that want to chase everyone else away and survive as lone wolves are going to have a very rough time. We all need each other, and those that have friends, family and communities around them are going to be in a much better position to weather the coming storms. So let us hope for the best, but let us also prepare for the worst… |

Monday, January 25, 2016

Just A Coincidence That A Historic Blizzard Named ‘Jonas’ Hit D.C. On The Anniversary Of Roe v Wade? - Michael Synder THE ECONOMIC COLLAPSE BLOG

|

Just A Coincidence That A Historic Blizzard Named ‘Jonas’ Hit D.C. On The Anniversary Of Roe v Wade?

Posted: 24 Jan 2016 Michael Synder THE ECONOMIC COLLAPSE BLOG

On January 22nd, one of the worst east coast blizzards in history slammed into Washington D.C. like a freight train. More than three feet of snow was dumped on some areas, hundreds of thousands of people were left without power, and coastal cities all long the eastern seaboard experienced flooding to a degree not seen since Hurricane Sandy.

Tens of millions of people live in communities that were completely paralyzed by this storm, and it is being projected that the total amount of economic damage done will ultimately be in the billions of dollars. January 22nd also happens to be the anniversary of the U.S. Supreme Court decision that legalized abortion in all 50 states. Since that Supreme Court decision, more than 58 million babies have been murdered in abortion clinics in America. Could it be possible that it is more than just a “coincidence” that both of these events happened on January 22nd? In a previous article, I noted that this east coast blizzard was officially given the name “Jonas”. It turns out that “Jonas” is actually a Greek transliteration of the Hebrew name “Jonah”. In the Bible, Jonah was sent to the city of Ninevah to warn that the judgment of God was about to come. Some are suggesting that it may not be any accident that a historic blizzard named after this Biblical prophet hit Washington D.C. on the exact anniversary of the Roe vs. Wade decision. And without a doubt, this was a whopper of a storm. According to USA Today, some cities broke their all-time records for snowfall from a single storm… It was the biggest snowstorm ever recorded for three cities — Baltimore (29.2 inches), Allentown, Pa. (31.9) and Harrisburg, Pa. (34), the National Weather Service said. New York City picked up 26.8 inches of snow, missing its all-time record by one-tenth of an inch.In the D.C. area things were absolutely crazy. Dulles Airport got a total of 29.3 inches of snow, and Baltimore-Washington International Airport got 29.2 inches of snow. Some of the outlying areas actually got closer to three feet of snow, and it could take weeks for transportation in the region to get back to normal. New York City got absolutely pummeled as well. CNN is reporting that John F. Kennedy International Airport got 31 inches of snow and New York’s Central Park has been buried under 27 inches of snow. In addition to crazy amounts of snow, vast stretches right along the coast had to deal with tremendous flooding. In fact, CNN is reporting that the flooding was even worse than during Hurricane Sandy in some areas… Margate City, just down the coast from Atlantic City, was also affected.Meanwhile, a very powerful El Nino pattern continues to send storm after storm slamming into the west coast. It didn’t get much publicity because of the giant blizzard on the east coast, but the California coastal city of Pacifica just declared a state of emergency due to the damage from these storms. The following comes from the Daily Mail… As the East Coast is hit with one of the most powerful storms in recent years, the West Coast is continuing to be slammed with storms thanks to El Nino.All of this continues a very unusual pattern of disasters that we have been witnessing over the past six months. Just consider what we have seen happen since last September… -Around the turn of the year the middle part of the country experienced absolutely horrific flooding. The only thing people can really compare it to is the great flood of 1993, and Missouri Governor Jay Nixon says that some communities saw floodwaters get to “places they’ve never been before”. Normally if the middle of the country is going to see flooding like this, it is going to happen when the snow begins to thaw in the spring. For something like this to happen in December is absolutely unprecedented. -Prior to that, a conveyor belt of storms that barreled into coastal areas of Oregon and Washington caused horrible flooding in many areas. In fact, in early December we witnessed the wettest day in the history of Portland, Oregon. The resulting landslides and floods made headlines all over the nation. -Before that, the remnants of Hurricane Patricia caused nightmarish flooding in many parts of Texas. The flooding was so bad that at one point an entire train was knocked off the tracks. -Out on the west coast, flash flooding in southern California sent rivers of mud streaming across highways in southern California. The lifeless body of one man that had his vehicle completely buried in mud was recovered several days later because that is how long it took emergency workers to get to him. -To kick things off, moisture from Hurricane Joaquin caused horrible flooding all up and down the east coast back in early October. The governor of South Carolina said that it was the worst rain that some parts of her state had seen in 1,000 years. All of this flooding has happened since the end of September. Never before in U.S. history have we ever seen a series of catastrophic floods like this within such a concentrated space of time. And let us not forget that 2015 was also the worst year for wildfires in all of U.S. history, the state of Oklahoma absolutely shattered their yearly record for earthquakes, and much of the rest of the country has been experiencing highly unusual natural disasters. In fact, the state of Alaska was hit by a 7.1 magnitude earthquake just today. In addition, my regular readers already know that global financial markets have just had their worst start to a year in all of modern history. Could someone be trying to tell us something? Most people out there would dismiss such a suggestion without even thinking about it. To most Americans, it must just be a “coincidence” that we have been hit by major disaster after major disaster since the month of September. But there are others that would point out that you eventually reap what you sow, and this nation has been doing a tremendous amount of evil for a very long time. As I mentioned at the top of this article, America has murdered more than 58 million babies since 1973. Instead of being horrified at our crimes, we just continue to shake our fist at God as we celebrate all of the evil that we are doing. In fact, Barack Obama took time out of his day on Friday to actually celebrate the anniversary of Roe v. Wade… President Barack Obama issued a statement today, celebrating the 43rd anniversary of the Supreme Court’s 1973 Roe v. Wade decision that declared abortion a constitutionally protected right.Despite being shown our guilt over and over again, we have absolutely refused to change our ways, and so now we will pay the price for our crimes. As I have said on television, on the radio and in my articles, 2016 is the year when everything changes. |

Saturday, December 26, 2015

58 Facts About The U.S. Economy From 2015 That Are Almost Too Crazy To Believe - Michael Synder THE ECONOMIC COLLAPSE BLOG

Michael Synder THE ECONOMIC COLLAPSE BLOG

Dec. 23, 2015

58 Facts About The U.S. Economy From 2015 That Are Almost Too Crazy To Believe

Dec. 23, 2015

58 Facts About The U.S. Economy From 2015 That Are Almost Too Crazy To Believe

The world didn’t completely fall apart in 2015, but it is undeniable that an immense amount of damage was done to the U.S. economy. This year the middle class continued to deteriorate, more Americans than ever found themselves living in poverty, and the debt bubble that we are living in expanded to absolutely ridiculous proportions.

Toward the end of the year, a new global financial crisis erupted, and it threatens to completely spiral out of control as we enter 2016. Over the past six months, I have been repeatedly stressing to my readers that so many of the exact same patterns that immediately preceded the financial crisis of 2008 are happening once again, and trillions of dollars of stock market wealth has already been wiped out globally.

Some of the largest economies on the entire planet such as Brazil and Canada have already plunged into deep recessions, and just about every leading indicator that you can think of is screaming that the U.S. is heading into one. So don’t be fooled by all the happy talk coming from Barack Obama and the mainstream media. When you look at the cold, hard numbers, they tell a completely different story. The following are 58 facts about the U.S. economy from 2015 that are almost too crazy to believe…

#1 These days, most Americans are living paycheck to paycheck. At this point 62 percent of all Americans have less than 1,000 dollars in their savings accounts, and 21 percent of all Americans do not have a savings account at all.

#2 The lack of saving is especially dramatic when you look at Americans under the age of 55. Incredibly, fewer than 10 percent of all Millennials and only about 16 percent of those that belong to Generation X have 10,000 dollars or more saved up.

#3 It has been estimated that 43 percent of all American households spend more money than they make each month.

#4 For the first time ever, middle class Americans now make up a minority of the population. But back in 1971, 61 percent of all Americans lived in middle class households.

#5 According to the Pew Research Center, the median income of middle class households declined by 4 percent from 2000 to 2014.

#6 The Pew Research Center has also found that median wealth for middle class households dropped by an astounding 28 percent between 2001 and 2013.

#7 In 1970, the middle class took home approximately 62 percent of all income. Today, that number has plummeted to just 43 percent.

#8 There are still 900,000 fewer middle class jobs in America than there were when the last recession began, but our population has gotten significantly larger since that time.

#9 According to the Social Security Administration, 51 percent of all American workers make less than $30,000 a year.

#10 For the poorest 20 percent of all Americans, median household wealth declined from negative 905 dollars in 2000 to negative 6,029 dollars in 2011.

#11 A recent nationwide survey discovered that 48 percent of all U.S. adults under the age of 30 believe that “the American Dream is dead”.

#12 Since hitting a peak of 69.2 percent in 2004, the rate of home ownership in the United States has been steadily declining every single year.

#13 At this point, the U.S. only ranks 19th in the world when it comes to median wealth per adult.

#14 Traditionally, entrepreneurship has been one of the primary engines that has fueled the growth of the middle class in the United States, but today the level of entrepreneurship in this country is sitting at an all-time low.

#15 For each of the past six years, more businesses have closed in the United States than have opened. Prior to 2008, this had never happened before in all of U.S. history.

#16 If you can believe it, the 20 wealthiest people in this country now have more money than the poorest 152 million Americans combined.

#17 The top 0.1 percent of all American families have about as much wealth as the bottom 90 percent of all American families combined.

#18 If you have no debt and you also have ten dollars in your pocket, that gives you a greater net worth than about 25 percent of all Americans.

#19 The number of Americans that are living in concentrated areas of high poverty has doubled since the year 2000.

#20 An astounding 48.8 percent of all 25-year-old Americans still live at home with their parents.

#21 According to the U.S. Census Bureau, 49 percent of all Americans now live in a home that receives money from the government each month, and nearly 47 million Americans are living in poverty right now.

#22 In 2007, about one out of every eight children in America was on food stamps. Today, that number is one out of every five.

#23 According to Kathryn J. Edin and H. Luke Shaefer, the authors of a new book entitled “$2.00 a Day: Living on Almost Nothing in America“, there are 1.5 million “ultrapoor” households in the United States that live on less than two dollars a day. That number has doubled since 1996.

#24 46 million Americans use food banks each year, and lines start forming at some U.S. food banks as early as 6:30 in the morning because people want to get something before the food supplies run out.

#25 The number of homeless children in the U.S. has increased by 60 percent over the past six years.

#26 According to Poverty USA, 1.6 million American children slept in a homeless shelter or some other form of emergency housing last year.

#27 Police in New York City have identified 80 separate homeless encampments in the city, and the homeless crisis there has gotten so bad that it is being described as an “epidemic”.

#28 If you can believe it, more than half of all students in our public schools are poor enough to qualify for school lunch subsidies.

#29 According to a Census Bureau report that was released a while back, 65 percent of all children in the U.S. are living in a home that receives some form of aid from the federal government.

#30 According to a report that was published by UNICEF, almost one-third of all children in this country “live in households with an income below 60 percent of the national median income”.

#31 When it comes to child poverty, the United States ranks 36th out of the 41 “wealthy nations” that UNICEF looked at.

#32 An astounding 45 percent of all African-American children in the United States live in areas of “concentrated poverty”.

#33 40.9 percent of all children in the United States that are being raised by a single parent are living in poverty.

#34 There are 7.9 million working age Americans that are “officially unemployed” right now and another 94.4 million working age Americans that are considered to be “not in the labor force”. When you add those two numbers together, you get a grand total of 102.3 million working age Americans that do not have a job right now.

#35 According to a recent Pew survey, approximately 70 percent of all Americans believe that “debt is a necessity in their lives”.

#36 53 percent of all Americans do not even have a minimum three-day supply of nonperishable food and water at home.

#37 According to John Williams of shadowstats.com, if the U.S. government was actually using honest numbers the unemployment rate in this nation would be 22.9 percent.

#38 Back in 1950, more than 80 percent of all men in the United States had jobs. Today, only about 65 percent of all men in the United States have jobs.

#39 The labor force participation rate for men has plunged to the lowest level ever recorded.

#40 Wholesale sales in the U.S. have fallen to the lowest level since the last recession.

#41 The inventory to sales ratio has risen to the highest level since the last recession. This means that there is a whole lot of unsold inventory that is just sitting around out there and not selling.

#42 The ISM manufacturing index has fallen for five months in a row.

#43 Orders for “core” durable goods have fallen for ten months in a row.

#44 Since March, the amount of stuff being shipped by truck, rail and air inside the United States has been falling every single month on a year over year basis.

#45 Wal-Mart is projecting that its earnings may fall by as much as 12 percent during the next fiscal year.

#46 The Business Roundtable’s forecast for business investment in 2016 has dropped to the lowest level that we have seen since the last recession.

#47 Corporate debt defaults have risen to the highest level that we have seen since the last recession. This is a huge problem because corporate debt in the U.S. has approximately doubled since just before the last financial crisis.

#48 Holiday sales have gone negative for the first time since the last recession.

#49 The velocity of money in the United States has dropped to the lowest level ever recorded. Not even during the depths of the last recession was it ever this low.

#50 Barack Obama promised that his program would result in a decline in health insurance premiums by as much as $2,500 per family, but in reality average family premiums have increased by a total of $4,865 since 2008.

#51 Today, the average U.S. household that has at least one credit card has approximately $15,950 in credit card debt.

#52 The number of auto loans that exceed 72 months has hit at an all-time high of 29.5 percent.

#53 According to Dr. Housing Bubble, there have been “nearly 8 million homes lost to foreclosure since the home ownership rate peaked in 2004″.

#54 One very disturbing study found that approximately 41 percent of all working age Americans either currently have medical bill problems or are paying off medical debt. And collection agencies seek to collect unpaid medical bills from about 30 million of us each and every year.

#55 The total amount of student loan debt in the United States has risen to a whopping 1.2 trillion dollars. If you can believe it, that total has more than doubled over the past decade.

#56 Right now, there are approximately 40 million Americans that are paying off student loan debt. For many of them, they will keep making payments on this debt until they are senior citizens.

#57 When you do the math, the federal government is stealing more than 100 million dollars from future generations of Americans every single hour of every single day.

#58 An astounding 8.16 trillion dollars has already been added to the U.S. national debt while Barack Obama has been in the White House. That means that it is already guaranteed that we will add an average of more than a trillion dollars a year to the debt during his presidency, and we still have more than a year left to go.

What we have seen so far is just the very small tip of a very large iceberg. About six months ago, I stated that “our problems will only be just beginning as we enter 2016″, and I stand by that prediction.

We are in the midst of a long-term economic collapse that is beginning to accelerate once again. Our economic infrastructure has been gutted, our middle class is being destroyed, Wall Street has been transformed into the biggest casino in the history of the planet, and our reckless politicians have piled up the biggest mountain of debt the world has ever seen.

Anyone that believes that everything is “perfectly fine” and that we are going to come out of this “stronger than ever” is just being delusional. This generation was handed the keys to the finest economic machine of all time, and we wrecked it. Decades of incredibly foolish decisions have culminated in a crisis that is now reaching a crescendo, and this nation is in for a shaking unlike anything that it has ever seen before.

So enjoy the rest of 2015 while you still can.

2016 is almost here, and it is going to be quite a year…

LOVE FOR HIS PEOPLE FEATURED BOOK

Look here: Amazon - paperback $5.95 Kindle $2.99

Thursday, November 19, 2015

If The Economy Is Fine, Why Are So Many Hedge Funds, Energy Companies And Large Retailers Imploding? - MICHAEL SYNDER THE ECONOMIC COLLAPSE BLOG

If The Economy Is Fine, Why Are So Many Hedge Funds, Energy Companies And Large Retailers Imploding? If The Economy Is Fine, Why Are So Many Hedge Funds, Energy Companies And Large Retailers Imploding?

MICHAEL SYNDER THE ECONOMIC COLLAPSE BLOG

Posted: 18 Nov 2015 04:06 PM PST

If the U.S. economy really is in “great shape”, then why do all of the numbers keep telling us that we are in a recession? The manufacturing numbers say that we are in a recession, the trade numbers say that we are in a recession, and as you will see below the retail numbers say that we are in a recession. But just like in 2008, the Federal Reserve and our top politicians will continue to deny that a major economic downturn is happening for as long as they possibly can. In this article, I want to look at more signs that a dramatic shift is happening in our economy right now.

First of all, let’s consider what is happening to hedge funds. For many years, hedge funds had been doing extremely well, but now they are closing up shop at a pace that we haven’t seen since the last financial crisis. The following is an excerpt from a Business Insider article entitled “Hedge funds keep on imploding” that was posted on Wednesday… BlackRock is winding down its Global Ascent Fund, a global macro hedge fund that once contained $4.6 billion in assets, according to Bloomberg’s Sabrina Willmer.And those are just two examples. Quite a few other prominent hedge funds have shut down recently, and many are wondering if this is just the beginning of a major “bloodbath” on Wall Street. Another troubling sign is the implosion of so many energy companies. Just like in 2008, a major crash in the price of oil is hitting the energy sector really hard. Just check out these stock price declines… -Cabot Oil & Gas down 37.27 percent over the past 12 months -Southwestern Energy down 68.11 percent over the past 12 months -Chesapeake Energy down 73.98 percent over the past 12 months A number of smaller energy companies have already gone out of business, and several of the big players are teetering on the brink. If the price of oil does not rebound significantly very soon, it is just a matter of time before the dominoes begin to fall. We are also seeing tremendous turmoil in the retail industry. The following comes from Investment Research Dynamics… The retail sales report for October was much worse than expected. Not only that, but the Government’s original estimates for retail sales in August and September were revised lower. A colleague of mine said he was chatting with his brother, who is a tax advisor, this past weekend who said he doesn’t understand how the Government can say the economy is growing (Hillary Clinton recently gave the economy an “A”) because his clients are lowering their estimated tax payments. Businesses lower their estimated tax payments when their business activity slows down. The holiday season is always the best time of the year for retailers, but in 2015 there is a lot of talk of gloom and doom. Most large retailers will not start announcing mass store closings until January or February, but without a doubt many analysts are anticipating that once we get past the Christmas shopping season we will see stores shut down at a pace that we haven’t seen since at least 2009. Here is more from the article that I just quoted above… Retail sales this holiday season are setting up to be a disaster. Already most retailers are advertising “pre-Black Friday” sales events. Remember when holiday shopping didn’t begin, period, until the day after Thanksgiving? Now retailers are going to cannibalize each other with massive discounting beforeThanksgiving. Anybody notice over the weekend that BMW is now offering $6500 price rebates? The collapsing economy is affecting everyone, across all income demographics. Last week we saw the stocks of Macy’s, Nordstrom and Advance Auto Parts do cliff-dives after they announced their earnings. I mentioned to a colleague that the Nordstrom’s report should be the most troubling for analysts. Nordstrom in their investor conference call said that they began seeing an “unexplainable slowdown in sales in August in transactions across all formats, across all catagories and across all geographies that has yet to recover.”I think that a chart would be helpful to give you an idea of how bad things have already gotten. Jim Quinn shared this in an article that he just posted, and it shows the change in retail sales once you remove the numbers for the auto industry. As you can see, the numbers have never been this dreadful outside of a recession…  But stocks went up 247 points on Wednesday so everything must be great, right? Wrong. The stock market has never been a good barometer for the overall economy, and this is especially true these days. In 2008, stocks didn’t crash until well after the U.S. economy as a whole started crashing, and the same thing is apparently happening this time around as well. One of the things that is keeping stocks afloat for the moment is stock buybacks. In recent years, big corporations have spent hundreds of billions of dollars buying back their own stocks. The following comes from Wolf Richter… IBM has blown $125 billion on buybacks since 2005, more than the $111 billion it invested in capital expenditures and R&D. It’s staggering under its debt, while revenues have been declining for 14 quarters in a row. It cut its workforce by 55,000 people since 2012. And its stock is down 38% since March 2013.Later in that same article, Richter explains that almost 60 percent of all publicly traded non-financial corporations have engaged in stock buybacks over the past five years… Nearly 60% of the 3,297 publicly traded non-financial US companies Reuters analyzed have engaged in share buybacks since 2010. Last year, the money spent on buybacks and dividends exceeded net income for the first time in a non-recession period.Big corporations like to do this for a couple of reasons. Number one, it pushes the price of the stock higher, and current investors appreciate that. Number two, corporate executives are usually in favor of conducting stock buybacks because it increases the value of their stock options and their own stock holdings. But now corporate profits are falling and it is becoming tougher for big corporations to borrow money. So look for stock buybacks to start to decline significantly. Even though it is taking a bit longer than many would have anticipated, the truth is that we are right on track for a massive financial collapse. All of the indicators that I watch are flashing red, and even though things are moving slowly, they are definitely moving in the same direction that we saw in 2008. But just like in 2008, there will be people that mock the warnings up until the day when it becomes completely and utterly apparent that the mockers were dead wrong. |

Subscribe to:

Comments (Atom)