|

Posted: 25 Jan 2017 05:57 Michael Snyder THE ECONOMIC COLLAPSE BLOG

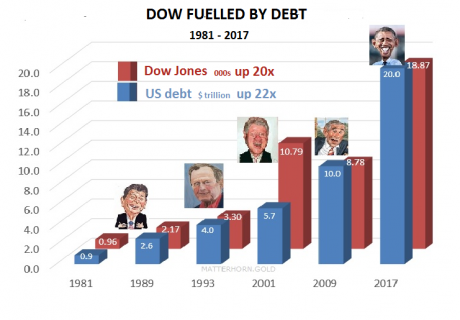

The Dow Jones Industrial Average provides us with some pretty strong evidence that our “stock market boom” has been fueled by debt. On Wednesday, the Dow crossed the 20,000 mark for the first time ever, and this comes at a time when the U.S. national debt is right on the verge of hitting 20 trillion dollars. Is this just a coincidence? As you will see, there has been a very close correlation between the national debt and the Dow Jones Industrial Average for a very long time.

For example, when Ronald Reagan took office in 1991, the U.S. national debt had just hit 994 billion dollars and the Dow was sitting at 951. And as you can see from this chart by Matterhorn.gold via David Stockman, roughly that same ratio has held true throughout subsequent presidential administrations… During the Clinton years the Dow raced out ahead of the national debt, but an “adjustment” during the Bush years brought things back into line. The cold hard truth is that we have been living way above our means for decades. Our “prosperity” has been fueled by the greatest debt binge in the history of the world, and we are greatly fooling ourselves if we think otherwise. We would never have gotten to 20,000 on the Dow if Barack Obama and Congress had not gotten us into an extra 9.3 trillion dollars of debt over the past eight years. Unfortunately, most people do not understand this, and the mainstream media is treating “Dow 20,000″ as if it is some sort of great historical achievement… The average began tracking the most powerful corporate stocks in 1896, and has served as a broad measure of the market’s health through 22 presidents, 22 recessions, a Great Depression, at least two crashes and innumerable rallies, corrections, bull and bear markets. The blue chip reading finally cracked the 20,000 benchmark for the first time early Wednesday.Since Donald Trump’s surprise election victory, the Dow has now climbed by approximately 2150 points. And it took just 64 calendar days for the Dow to go from 19,000 to 20,000. That is an astounding pace, and financial markets around the rest of the planet are doing very well right now too. In fact, global stocks rose to a 19 month high on Wednesday. So where do we go from here? Well, if Donald Trump wants to see Dow 30,000 during his presidency, then history tells us that he needs to take us to 30 trillion dollars in debt. Of course that would be absolute insanity even if it was somehow possible. Each additional dollar of debt destroys the future of our country just a little bit more, and at some point this colossal bubble is going to burst. But you can’t tell most of the “financial experts” these things. Most of them simply believe that the “market always goes higher over time”… The “market always goes higher over time,” Todd Morgan, chairman of Bel Air Investment Advisors. “The lesson here is that through wars, recessions, elections, impeachments, financial crises, and on and on, investing for the long term in high-quality stocks is the key to building wealth. … We are telling our clients that you can’t time the market. Think long term. Stay the course. We expect the market to see Dow 30,000 in my lifetime, and for my grandchildren to see Dow 50,000 in their lifetime.”My hope is that the market will continue to go up. But nobody can deny that valuations are already at absurdly high levels, and the only way that this party can keep going is to continue to fuel it with more and more debt. But for the moment, there is a tremendous amount of optimism out there, and most experts expect the Dow to continue to set new highs. In fact, CNBC says that whenever the Dow crosses a new threshold like this it usually means good things for investors… CNBC looked at market data from the past 30 years and zeroed in on the times when the Dow has crossed levels like 2,000, 3,000, 4,000 … all the way up to the 19,000 level it hit in November. At those times, investors can typically expect traders to push it up even higher, according to data from Kensho. Not only does the Dow go up, but it outperforms the S&P 500 index along the way.But as USA Today has explained, not all Americans are benefiting from this stock market rally… The breakthrough came just four trading days into Trump’s presidency, a whirlwind in which the billionaire has reaffirmed his commitment to strengthen the U.S. economy and create more jobs and higher wages for workers. Still, nearly half of Americans have not benefited from the so-called “Trump Rally,” which has generated more than $2.2 trillion in paper gains for the Wilshire 5000 Total Stock Index since Election Day. The reason: only 52% of Americans polled by Gallup last April said they “have money invested in stocks” — the lowest stock ownership rate in the 19 years Gallup has tracked the data and down sharply from 65% in 2007 before the financial crisis.Hopefully the good times will continue to roll for as long as possible. But there is no possible way that they can keep going indefinitely. For decades, our debt has been growing much faster than our GDP has. By definition, this is an unsustainable situation. At some point we will have accumulated so much debt that our financial system will no longer be able to hold up under the strain. Many were convinced that we would reach that point before the U.S. national debt hit 20 trillion dollars, and yet here we are. So how much higher can we go before the bubble bursts? That is a very good question, and I don’t know if anyone has the right answer. But for President Trump, this is going to present him with quite a dilemma. Either he can keep the debt party going for as long as possible, or he can try to get us to take some tough financial medicine right now. If an attempt is made to deal with our debt problems now, we will experience severe economic pain almost immediately. But if the can keeps being kicked down the road, our long-term prognosis is just going to keep getting worse and worse. And if we try to delay the inevitable indefinitely, at some point the laws of economics are going to make our hard choices for us. So let us celebrate “Dow 20,000″, but let us also understand that it is far more likely that we will see “Dow 10,000″ again before we ever see “Dow 30,000″. |

Showing posts with label National Debt. Show all posts

Showing posts with label National Debt. Show all posts

Thursday, January 26, 2017

Is It Just A Coincidence That The Dow Has Hit 20,000 At The Same Time The National Debt Is Reaching $20 Trillion? - Michael Snyder THE ECONOMIC COLLAPSE BLOG

Thursday, July 21, 2016

19.4 Trillion Dollars In Debt – We Have Added 1.1 Trillion Dollars A Year To The National Debt Under Obama - Michael Snyder THE ECONOMIC COLLAPSE BLOG

Posted: 20 Jul 2016 Michael Snyder THE ECONOMIC COLLAPSE BLOG

In 2006, U.S. Senator Barack Obama’s voice thundered across the Senate floor as he boldly declared that “increasing America’s debt weakens us domestically and internationally. Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren.” That was one of the truest things that he ever said, but just a couple of years later he won the 2008 election and he turned his back on those principles.

As I write this article, the U.S. national debt is sitting at a grand total of $19,402,361,890,929.46. But when Barack Obama first entered the White House, our federal government was only 10.6 trillion dollars in debt. That means that we have added an average of 1.1 trillion dollars a year to the national debt under Obama, and we still have about six more months to go.

Even though Barack Obama is on track to be the first president in all of U.S. history to not have a single year when the U.S. economy grew by 3 percent or better, many have still been mystified by the fact that the economy has been relatively stable in recent years.

But the explanation is rather simple, actually. Anyone can live like a millionaire if the credit card companies will lend them enough money. You could even do it yourself. Just go out and apply for as many credit cards as possible and then spend money like there is no tomorrow. In no time at all, you will be living the high life.

Of course many of you would immediately object that a day of reckoning would come eventually, and you would be right. Just like for those that abuse credit cards, a financial day of reckoning is coming for America too.

In the United States today, our standard of living is being massively inflated by taking trillions of dollars of future consumption and moving it into the present. The politicians love to do this because it makes them look good and they can take credit for an “economic recovery”, but what we are doing to our children and our grandchildren is beyond criminal.

On average, we are stealing more than 100 million dollars from future generations of Americans every single hour of every single day. We are complete and utter pigs, and yet most Americans don’t see anything wrong with what we are doing.

At this point, our national debt is more than 30 times larger than it was just 40 years ago, and many (including myself) have argued that it is now mathematically impossible for the U.S. government to ever pay off all of this debt.

The only thing that we can do now is to keep the party going for as long as possible until the day of reckoning inevitably comes.

Under Obama, our national debt will come close to doubling. What that means is that during Obama’s eight years we will accumulate almost as much debt as we did under all of the other presidents in U.S. history combined.

Right now, the U.S. government is responsible for about a third of all the government debt in the entire world. Fortunately the financial world continues to lend us gigantic mountains of money at ridiculously low interest rates, but if that were to ever change we would be in an enormous amount of trouble very rapidly.

For instance, if the average rate of interest on U.S. government debt simply returns to the long-term average, we would very quickly find ourselves spending more than a trillion dollars a year just in interest on the national debt.

And as the Baby Boomers age, our “unfunded liabilities” threaten to absolutely swamp us. By the year 2025, it is being projected that “mandatory” federal spending on “unfunded liabilities” such as Social Security, Medicaid and Medicare plus interest on the national debt will exceed total federal revenue. What that means is that we will spend every penny we bring in before a single dollar is spent on the military, homeland security, paying federal workers, building roads and bridges, etc.

In recent years the Federal Reserve has also had a “buy now, pay later” mentality.

While Obama has been in the White House, the size of the Fed balance sheet has grown by about two and a half trillion dollars. The goal has been to artificially pump up the economy, but when the Federal Reserve creates money out of thin air it is actually a tax on all of us. The purchasing power of every dollar that we will spend in the future has been diminished thanks to the Fed, but most Americans don’t understand this.

What most Americans want is for someone to “fix things” in the short-term, and not much consideration is ever given to the long-term damage that is being done.

I know that the phrase “trillion dollars” is thrown around a lot these days, and to a lot of people it doesn’t have a whole lot of meaning anymore. But the truth is that it is an absolutely enormous amount of money. In fact, if you went out right this moment and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars.

A final example of our “buy now, pay later” mentality can be seen in our ridiculously bloated trade deficit. We consume far more than we produce as a nation, and we buy far more from the rest of the world than they buy from us. As a result, tens of thousands of businesses and millions of good paying jobs have gone overseas, and many of our formerly great manufacturing cities are now vast industrial wastelands. Our economic infrastructure has been gutted at a pace that is staggering, and yet most Americans still don’t understand what has been done to them.

If you visit your typical “big box” retail store today, where is most of the stuff made?

Instinctively, most of you would answer “China”, and that is not too far from the truth.

We buy far, far more stuff from China then they buy from us. This makes them steadily wealthier, and it makes us steadily poorer. Unfortunately, our trade deficit with China has gotten much, much worse while Barack Obama has been in the White House.

At the end of Barack Obama’s first year in office, our yearly trade deficit with China was 226 billion dollars. Last year, it was more than 367 billion dollars.

Are you starting to see a trend?

Our long-term economic and financial problems have greatly accelerated under Barack Obama, but our leaders feverishly work to make things look okay in the short-term and so most Americans don’t notice what is happening.

Unfortunately, this Ponzi scheme cannot go on forever and a day of reckoning is coming. And when it arrives, the pain that it is going to cause for ordinary Americans is going to be far greater than most of us would dare to imagine.

As I write this article, the U.S. national debt is sitting at a grand total of $19,402,361,890,929.46. But when Barack Obama first entered the White House, our federal government was only 10.6 trillion dollars in debt. That means that we have added an average of 1.1 trillion dollars a year to the national debt under Obama, and we still have about six more months to go.

Even though Barack Obama is on track to be the first president in all of U.S. history to not have a single year when the U.S. economy grew by 3 percent or better, many have still been mystified by the fact that the economy has been relatively stable in recent years.

But the explanation is rather simple, actually. Anyone can live like a millionaire if the credit card companies will lend them enough money. You could even do it yourself. Just go out and apply for as many credit cards as possible and then spend money like there is no tomorrow. In no time at all, you will be living the high life.

Of course many of you would immediately object that a day of reckoning would come eventually, and you would be right. Just like for those that abuse credit cards, a financial day of reckoning is coming for America too.

In the United States today, our standard of living is being massively inflated by taking trillions of dollars of future consumption and moving it into the present. The politicians love to do this because it makes them look good and they can take credit for an “economic recovery”, but what we are doing to our children and our grandchildren is beyond criminal.

On average, we are stealing more than 100 million dollars from future generations of Americans every single hour of every single day. We are complete and utter pigs, and yet most Americans don’t see anything wrong with what we are doing.

At this point, our national debt is more than 30 times larger than it was just 40 years ago, and many (including myself) have argued that it is now mathematically impossible for the U.S. government to ever pay off all of this debt.

The only thing that we can do now is to keep the party going for as long as possible until the day of reckoning inevitably comes.

Under Obama, our national debt will come close to doubling. What that means is that during Obama’s eight years we will accumulate almost as much debt as we did under all of the other presidents in U.S. history combined.

Right now, the U.S. government is responsible for about a third of all the government debt in the entire world. Fortunately the financial world continues to lend us gigantic mountains of money at ridiculously low interest rates, but if that were to ever change we would be in an enormous amount of trouble very rapidly.

For instance, if the average rate of interest on U.S. government debt simply returns to the long-term average, we would very quickly find ourselves spending more than a trillion dollars a year just in interest on the national debt.

And as the Baby Boomers age, our “unfunded liabilities” threaten to absolutely swamp us. By the year 2025, it is being projected that “mandatory” federal spending on “unfunded liabilities” such as Social Security, Medicaid and Medicare plus interest on the national debt will exceed total federal revenue. What that means is that we will spend every penny we bring in before a single dollar is spent on the military, homeland security, paying federal workers, building roads and bridges, etc.

In recent years the Federal Reserve has also had a “buy now, pay later” mentality.

While Obama has been in the White House, the size of the Fed balance sheet has grown by about two and a half trillion dollars. The goal has been to artificially pump up the economy, but when the Federal Reserve creates money out of thin air it is actually a tax on all of us. The purchasing power of every dollar that we will spend in the future has been diminished thanks to the Fed, but most Americans don’t understand this.

What most Americans want is for someone to “fix things” in the short-term, and not much consideration is ever given to the long-term damage that is being done.

I know that the phrase “trillion dollars” is thrown around a lot these days, and to a lot of people it doesn’t have a whole lot of meaning anymore. But the truth is that it is an absolutely enormous amount of money. In fact, if you went out right this moment and started spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars.

A final example of our “buy now, pay later” mentality can be seen in our ridiculously bloated trade deficit. We consume far more than we produce as a nation, and we buy far more from the rest of the world than they buy from us. As a result, tens of thousands of businesses and millions of good paying jobs have gone overseas, and many of our formerly great manufacturing cities are now vast industrial wastelands. Our economic infrastructure has been gutted at a pace that is staggering, and yet most Americans still don’t understand what has been done to them.

If you visit your typical “big box” retail store today, where is most of the stuff made?

Instinctively, most of you would answer “China”, and that is not too far from the truth.

We buy far, far more stuff from China then they buy from us. This makes them steadily wealthier, and it makes us steadily poorer. Unfortunately, our trade deficit with China has gotten much, much worse while Barack Obama has been in the White House.

At the end of Barack Obama’s first year in office, our yearly trade deficit with China was 226 billion dollars. Last year, it was more than 367 billion dollars.

Are you starting to see a trend?

Our long-term economic and financial problems have greatly accelerated under Barack Obama, but our leaders feverishly work to make things look okay in the short-term and so most Americans don’t notice what is happening.

Unfortunately, this Ponzi scheme cannot go on forever and a day of reckoning is coming. And when it arrives, the pain that it is going to cause for ordinary Americans is going to be far greater than most of us would dare to imagine.

Subscribe to:

Comments (Atom)